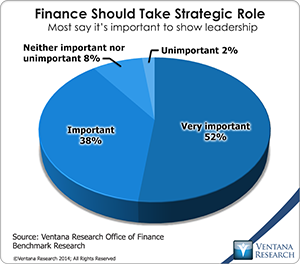

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and  take a strategic role in running their company. The research also shows a significant gap between this objective and how well most departments perform. A large majority (83%) said they perform the core finance functions of accounting, fiscal control, transaction

take a strategic role in running their company. The research also shows a significant gap between this objective and how well most departments perform. A large majority (83%) said they perform the core finance functions of accounting, fiscal control, transaction

Despite these findings, we believe that today finance transformation is both necessary and achievable. Practical, affordable technology is available to enhance productivity in order to de-emphasize the department’s “bean counting” role and promote its ability to enhance the performance of the entire corporation. Technology enables Finance to be more proactive and more strategic in providing analyses and methods that enhance its capabilities and improve the performance of the entire corporation. Of course, technology by itself will not transform a finance organization, but most of the longstanding issues that it must address to improve performance can be fixed using

Our Office of Finance research agenda for 2016 emphasizes three broad technology-related themes serving the goal of finance transformation:

- Applying a continuous accounting approach to promote greater departmental efficiency and effectiveness

- Adopting technology that promotes action-oriented continuous planning, using rapid, short planning cycles to promote agility, coordination and accountability

- Using software and other information technologies to achieve continuous optimization to promote ongoing organizational alignment across departments and business units.

Continuous Accounting

We introduced the term “continuous accounting” last year to identify the three areas where our research consistently finds tactical roadblocks to achieving a more strategic finance organization. By focusing on these three areas, finance executives can achieve steady gains in effectiveness.

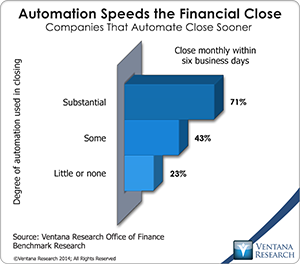

The first area concerns how the organization uses technology and manages information. To enhance effectiveness, finance departments must use software to automate all mechanical, repetitive accounting processes in a continuous, end-to-end fashion. Automation improves efficiency by eliminating the need to have people perform repetitive tasks. For example, we find that most (71%) companies that automate substantially all of their financial close complete it within six business days of the end of the quarter, compared to 43 percent that automate some of the process and just 23 percent that have automated little or none of it. Using software enables the department to manage the flow of data through its processes in a continuous, end-to-end fashion. This ensures data integrity, which in turn eliminates the need for checks and reconciliations that can consume time that could be spent more productively. Data integrity is undermined every time data is re-entered manually or when a spreadsheet is used in a process: for example, when data from one system is manually transferred to another; when the same information is entered twice in two different systems; or when a spreadsheet is used to perform an allocation or a set of calculations.

The first area concerns how the organization uses technology and manages information. To enhance effectiveness, finance departments must use software to automate all mechanical, repetitive accounting processes in a continuous, end-to-end fashion. Automation improves efficiency by eliminating the need to have people perform repetitive tasks. For example, we find that most (71%) companies that automate substantially all of their financial close complete it within six business days of the end of the quarter, compared to 43 percent that automate some of the process and just 23 percent that have automated little or none of it. Using software enables the department to manage the flow of data through its processes in a continuous, end-to-end fashion. This ensures data integrity, which in turn eliminates the need for checks and reconciliations that can consume time that could be spent more productively. Data integrity is undermined every time data is re-entered manually or when a spreadsheet is used in a process: for example, when data from one system is manually transferred to another; when the same information is entered twice in two different systems; or when a spreadsheet is used to perform an allocation or a set of calculations.

The second aspect of continuous accounting involves optimizing scheduling of tasks. Continuous accounting incorporates a process management approach that, wherever possible, distributes workloads continuously to flatten spikes of activities, whether in the month, quarter, half-year or year. This approach eliminates bottlenecks and optimizes when tasks are executed. It reduces stress on the department and can eliminate the need for temporary help and its associated expense. Much of the traditional accounting cycle and related departmental practices are artifacts of paper-based bookkeeping systems. These methods dictated the need to wait until the end the month, quarter or year to take accountants off line to perform aggregations, allocations, checks and reconciliations; that rhythm represented the best trade-off of efficiency and control in such antiquated approaches. Today’s systems offer far more flexibility that enables departments to spread workloads more evenly over time and complete them more expeditiously.

The third aspect of continuous accounting is the need to instill continuous improvement in the departmental culture. This steps counters tendency of any organization – but especially finance – to embrace a “we’ve always done it this way” mindset that resists needed change. Continuous improvement acts as a mission statement that sets increasingly rigorous objectives. To achieve those objectives it’s necessary to have regular reviews of performance toward those objectives and make addressing shortcomings a priority. For departmental executives, communicating the need for continuous improvement is an essential element to achieving finance transformation.

Used as an organizing principle for the department, continuous accounting frees up time and therefore the resources needed to implement changes that result in performance improvements in a sustained and steady fashion. Adopting a continuous accounting approach enables CFOs and finance executives to reduce the amount of time spent “fighting fires,” many of which are the result of not using capable technology.

The Transformation of ERP

In most companies, ERP systems are the backbone of the accounting function, and this software category will continue to be an important focus of our research in 2016. The ERP software market is set to undergo a significant transformation over the next five years. At the heart of this transformation is the decade-long evolution of a set of technologies that enable a major shift in the design of these systems – and it amounts to the most significant change since the introduction of client/server technology in the 1990s. Vendors are seizing on technologies such as in-memory computing, improving the user interface and user experience, adding more in-context collaboration and extending the use of mobility to differentiate their applications from rivals. Those with software-as-a-service (SaaS) subscription offerings are investing to make their software suitable for a broader variety of users in multitenant clouds. These and other topics will be addressed in the results of our next-generation ERP benchmark research, which we will release in 2016.

We’ll also continue to look at the application of financial  performance management (FPM) to improve results. Ventana Research defines FPM as the process of addressing the often overlapping issues that affect how well finance organizations support the activities and strategic objectives of their companies and manage their own

performance management (FPM) to improve results. Ventana Research defines FPM as the process of addressing the often overlapping issues that affect how well finance organizations support the activities and strategic objectives of their companies and manage their own

Financial Performance Management

As noted above, we recommend that finance organizations that want to play a more strategic role in the management of their corporation should adopt a continuous planning methodology for their financial planning and analysis function. A continuous planning approach uses frequent, short planning cycles to promote agility, coordination and accountability in operations. It includes establishing an ongoing dialogue among finance and line-of-business managers and executives to track current conditions as well as changes in objectives and priorities driven by markets and the business climate. To manage planning in such a comprehensive way requires dedicated software that enables members of the

Sales and Operations Planning for Finance

Companies that deal in physical goods that are manufactured or sourced and then sold direct or into distribution channels often benefit from using sales and operations planning (S&OP). The process of orchestrating the flow of parts and materials through the production process to meet expected customer demand involves many functional units, each of which make plans, as well as the finance organization, which assesses the financial impact. Sales and operations planning is a discipline aimed at aligning and optimizing the plans of several business units. There are sales plans, product plans, demand plans and supply chain plans. Within a corporation, the performance of each of the functional units that produce these plans is assessed using different, often conflicting metrics. Information technology enables corporations to manage their inventories more skillfully and minimize their working capital investment while maximizing their ability to fulfill demand. S&OP is designed to align a company strategically so that it can execute tactically in more effective fashion. The ultimate goal is to determine how best to manage company resources, especially inventory and cash, to be able to profitably satisfy customer demand with the lowest incidence of stock-outs. The output of an S&OP group is a SKU-level demand forecast that is used to create a detailed inventory plan. This quantitative plan is a major driver of a process that guides the purchasing an optimal amount of inventory (the one that best balances desired fulfillment rates while minimizing the investment in inventory) from the best set of suppliers (balancing a range of considerations including goods availability, pricing, discounts, economic order quantities and supply chain constraints). To enhance their strategic value, the financial planning and analysis group should play an integral role in the sales and operations planning process.

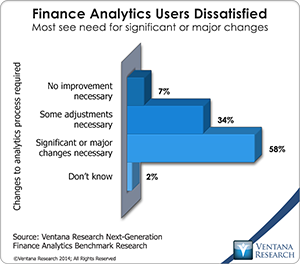

Advanced Analytics

We also will monitor the ongoing development of advanced analytics for business users. Using technology to make better use of data through advanced analytics can provide companies with breakthrough results. Often that’s because using capable information technology can provide insights and visibility that are unavailable by eyeballing data or using spreadsheets. Advanced techniques such as predictive analytics provide companies with more nuanced forecasts as well as the ability to spot deviations from expected results and thus address problems or seize opportunities sooner. For example, price and revenue optimization is rapidly developing applied analytic techniques that enable businesses to achieve higher profitability, increased sales or some combination. Software that helps manage pricing and profitability is spreading from hospitality, transportation, retailing to consumer financial services and other areas, especially business-to-business verticals. Used properly, this type of software enables a company to tailor its control of individual decisions regarding pricing, discounts and other terms to achieve the results best suited to its strategy. It can continuously make adjustments consistent with longer-term objectives in response to market conditions. Price and revenue optimization is impossible to achieve without using software and analytics that can deal with the huge volumes of today’s data.

Tools for Promoting Productivity and Effectiveness

There are a range of specialized software tools also can promote a more effective finance function, and executives must focus on acquiring and using those that enable the department to take a more active role in improving performance in the company’s operations. Finance has the necessary analytical talent and is positioned to be a neutral party in balancing the requirements of different functional groups or where issues cross business units or geographic boundaries.

The Office of Finance practice will continue to focus on software categories that can improve corporate efficiency, increase visibility and enhance agility. Our main objective is to enable finance organizations to be more effective by eliminating the root causes of time-wasting, low-value activities. For example, more companies are adopting a subscription or recurring revenue business model. This model isn’t always handled well by ERP systems, especially if a company is selling something more complex than simple subscriptions. These companies need to automate their quote-to-cash process from end to end, with the objective of controlling the flow of data, from configuring, quoting and pricing all the way to billing. Using this type of automation to ensure data quality enables companies to achieve two usually conflicting goals: substantially reducing finance and accounting department workloads while still allowing sales and

Managing Taxes More Intelligently

Taxes are one of the biggest expenses corporations face. There are two basic types of taxes: direct or income taxes and indirect taxes, which include sales and use

The Impact of Changes to Accounting Rules

The Office of Finance practice at Ventana invests a great deal of time in researching software applications and related information technology. Uniquely, though, we also read accounting bulletins. The world of accounting is undergoing a substantial change now and over the next three years as a result of the adoption of accounting rule changes for revenue recognition and, to a lesser extent, lease accounting. The impact of revenue recognition changes will be profound because it is built on a fundamentally different conceptual framework than classical accounting. The upshot of this framework is that systems must account for revenues and expenses in a parallel fashion rather than in a balancing one. This type of approach would have been extremely problematic in paper-based systems. It’s feasible only because of the nearly universal use of computer-based accounting systems. Almost all ERP vendors are gearing up to support the new accounting rules, but it’s important for companies to plan ahead to make the transition as smooth as possible. And it’s important to be sure that sales contracts and documentation are designed to make accounting for them as efficient as possible.

Technology’s Role in the Office of Finance

One major reason for investing in technology is to help senior executives achieve better results by supporting more effective business management techniques. For example, our benchmark research on long-range planning demonstrates that better management of technology and information can improve alignment between strategy and execution. And when it comes to cloud computing, far from simply being a technology concern, cloud computing enables corporations to cut costs and gain access to more sophisticated technology than they could feasibly support in an on-premises deployment. Using technology can boost performance. The improper use of spreadsheets as seen in our research continues be an unseen killer of corporate productivity because these tools have inherent defects that significantly reduce users’ efficiency. Relying on spreadsheets makes it impossible to find the time to improve performance. Increasingly companies have inexpensive options that are easier to use and enable more advanced, reliable modeling, analysis and reporting.

Information technology is an essential element of business management and promotes a discipline of continuous optimization, a term we use to emphasize the importance of achieving better alignment of organizations to a company’s strategy. Yet many senior executives and managers have too narrow and too limited an understanding of IT’s full potential, much as those managing corporate information technology usually don’t appreciate business issues and how IT can address them. The business/IT divide is a barrier that prevents many companies from achieving their performance potential. The divide need not exist. Business executives don’t have to be able to write Java code or master the intricacies of an ERP or sales compensation application. However, they should master the basics of IT just as they must understand the fundamentals of

Regards,

Robert Kugel – SVP Research