Many senior finance executives say they want their department to play a more strategic role in the

- Automating mechanical, repetitive accounting processes in a continuous, end-to-end fashion to improve efficiency, ensure data integrity and enhance visibility into processes

- Distributing workloads continuously over the accounting period (the month, quarter, half-year or year) to eliminate bottlenecks and optimize when tasks are executed

- Establishing a culture of continuous improvement in managing the accounting cycle. Such a culture regularly sets increasingly rigorous objectives, reviews performance to those objectives and makes addressing shortcomings a departmental priority.

Record-to-report is an approach to managing the accounting cycle as a repeatable end-to-end process spanning all of the steps beginning with booking transactions and moving all the way to publishing financial statements; it replaces handling the process as a series of loosely connected procedures. Continuous accounting is an evolutionary step beyond the record-to-report framework. Continuous accounting applies modern finance

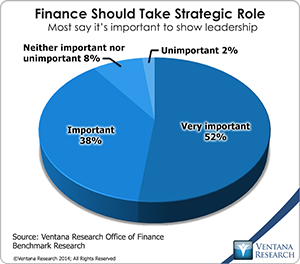

Continuous accounting is essential to a strategically focused finance organization. In our research on finance innovation, nine out of 10 participants said that it’s important or very important for finance departments to take a strategic role in running their company. Unfortunately there is a significant gap between this objective and how most of them perform.  Almost all (83%) companies perform core finance department functions of accounting, fiscal control, transactions management, financial reporting and internal audit, but only 41 percent play an active role in their company’s management. Just 25 percent have implemented a high degree of automation in their core finance functions and actively promote process and analytical excellence.

Almost all (83%) companies perform core finance department functions of accounting, fiscal control, transactions management, financial reporting and internal audit, but only 41 percent play an active role in their company’s management. Just 25 percent have implemented a high degree of automation in their core finance functions and actively promote process and analytical excellence.

Rather than just automating existing practices to improve efficiency, continuous accounting recognizes that longstanding processes may no longer be the best approach because today’s software offers greater flexibility in how and when elements of the accounting cycle are performed. It provides a foundation that enables the finance and accounting organization to better serve the needs of a modern corporation by being more responsive, forward-looking and agile. Moreover, when used as a concept to define and explain a department-wide change management initiative, continuous accounting can facilitate necessary changes in a department’s culture.

As a rule, using software to automate manual tasks improves efficiency and speeds the completion of processes. By eliminating human intervention (and therefore the potential for mistakes and misdeeds), automation can enhance financial control. End-to-end (continuous) process automation is achieved when numbers are entered only once, all calculations and analyses are performed programmatically by the system, and the system manages all workflows. These workflows handle the execution of every step in the same order, enforce approvals and sign-offs and control the roles, rules and responsibilities of those involved in performing the work.

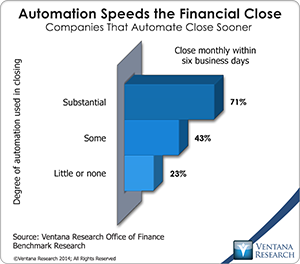

End-to-end process automation improves departmental efficiency. For example, we find that most (71%) companies that  automate substantially all of their financial close complete the close within six business days of the end of the quarter, compared to 43 percent that automate some of the process and just 23 percent that have automated little or none of it. End-to-end automation enhances financial control and facilitates audit processes by sustaining the integrity of the accounting data. Data integrity is concerned with the accuracy and consistency of data stored in a system. Properly configured, end-to-end automation enforces data integrity, eliminating the need for extra checks and reconciliations that become necessary when there is no single authoritative source of accounting and process-related data. In contrast, processes that incorporate manual steps (such as performing steps in a spreadsheet and then entering the resulting amounts back into the system) make it possible for errors and intentional fraud to enter the system.

automate substantially all of their financial close complete the close within six business days of the end of the quarter, compared to 43 percent that automate some of the process and just 23 percent that have automated little or none of it. End-to-end automation enhances financial control and facilitates audit processes by sustaining the integrity of the accounting data. Data integrity is concerned with the accuracy and consistency of data stored in a system. Properly configured, end-to-end automation enforces data integrity, eliminating the need for extra checks and reconciliations that become necessary when there is no single authoritative source of accounting and process-related data. In contrast, processes that incorporate manual steps (such as performing steps in a spreadsheet and then entering the resulting amounts back into the system) make it possible for errors and intentional fraud to enter the system.

Today’s financial management software offers flexibility that allows companies to reconsider how and when they perform their work. The monthly, quarterly and semiannual cadences of the accounting cycle are not set in stone. Much of what we think of as “normal” bookkeeping and accounting procedures are rooted in the centuries-old limitations imposed by paper-based systems and manual calculations. Periodic processes (performed, say, monthly or quarterly) developed as the best approach to organizing, coordinating and executing the calculations needed to sum up the debits and credits in journals and ledgers. The cadence of these manual systems represents a trade-off to balance efficiency and control. Their timing is the result of having to wait for sufficient volume of entries to justify taking the time to perform manual summations, adjustments and consolidations, while not waiting so long as to jeopardize financial control. Only recently has technology reached a threshold to support transformation of core finance and accounting processes to allow companies sufficient freedom to easily schedule the timing of their accounting cycle tasks to distribute workloads across the period.

The third main principle of continuous improvement is an approach to business process management. It involves ongoing assessments of an organization’s processes and the implementation of changes to improve their efficiency or effectiveness. Continuous improvement works because most often companies must address a set of small issues rather than a single big one to achieve better results. And continuous improvement recognizes that business is not static. As conditions change it’s necessary to adapt and modify processes, policies and procedures.

Continuous accounting is an essential discipline for finance organizations that want to play a more central and strategic role in their company. It provides a foundation for finance transformation and thus can separate innovative organizations and leaders from those content with the status quo.

Regards,

Robert Kugel – SVP Research