In my initial blog on P&L management, I presented pre-P&L analysis, which is the first step of the practical approach to P&L improvement I worked on during my time in FMCG and Pharmaceutical industries, both in country and global headquarters. The subject of today's post is price management.

When considering the first KPI of managerial reporting, Gross Sales, it is helpful to split it into two components: the volume of sold goods and the price, which we will look into next.

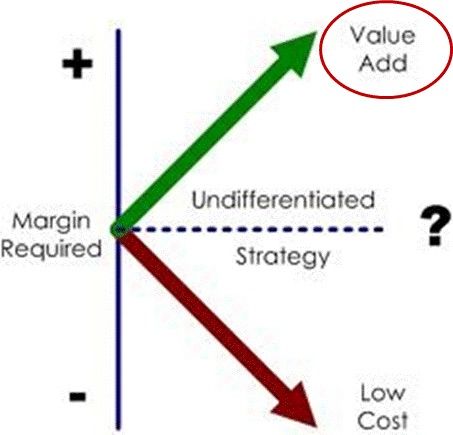

Taking Porter’s theory on Competitive advantage as a starting point (Porter, 1998), a company can consider price either to be defined by the market and focus on cost

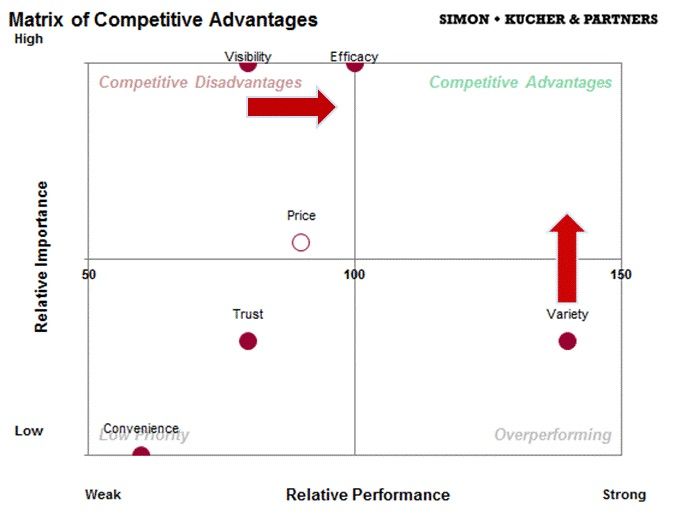

Having committed to the strategy of Differentiation, the next challenge is to estimate product value for the customer, expressed in her willingness to pay, and measured by the price. Among widely used price-setting methods, value-based pricing is the most challenging and potentially the most rewarding. The reward in this case can be manifold. It’s not only about allowing a company to set the price that most closely reflects customer’s willingness to pay, but also focusing its efforts on collecting relevant information, and understanding and increasing value of the product by promotional and product development activities. Although most of the insights on product value come from market research, it is worth using a systematic way to structure this information in order to measure the product value. An example of such a tool is “ComStrat” from Simon-Kucher & Partners, which also helps figure out how to drive up value for each product and set up a direction for product promotion. In the Matrix of Competitive Advantage (a view of ComStrat, see the picture below), factors affecting the product choice made by consumers are graded by their importance, and products of the company and its competitor are evaluated in terms of performance based on consumer preferences. The company can choose either to work on improving its performance on key factors (e.g., increase Visibility of its products in the picture below), or focus on communicating to consumers the importance of factors where it already has an edge (Variety in this example).

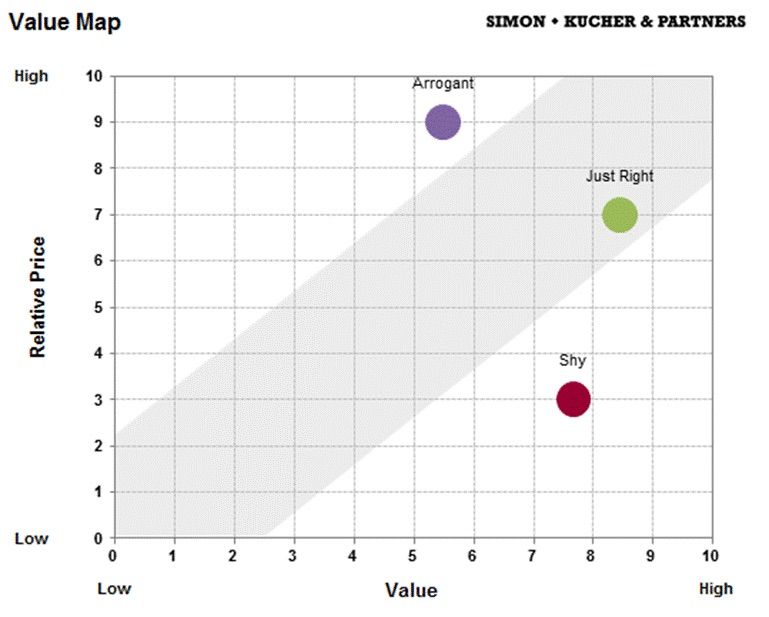

Having understood the product value, a company can further “weigh it” by comparing it with the price, which can be done in the second view of ComStrat called Value Map (see below). In the coordinate system “Relative price - Value”, a product can be located in three positions vs. competition:

-

Balance corridor: price and value are balanced, e.g. high value corresponds to high price (product “Just Right” in the picture below)

-

Overpriced: price is too high for a product with relatively low value (“Arrogant”)

-

Underpriced: product value is higher than its price (“Shy”).

Although position 3 looks ideal, it is not always the case as the price is also an attribute of value. For example, Mercedes offered at the price of Lada not only would look suspicious, but also lose some of its image and perceived value. However, if carefully thought through and correctly communicated to consumers, the strategy where perceived product value is higher than the set price is a direct way to success. For example, Lee Iacocca [Iacocca Novak, 1986] gives an example of application of this strategy, when Ford launched its Mustang brand. According to

All in all, Price is a strong lever of the company performance, which is often underestimated. Having mastered price management skills, company gets a strong boost not only in top, but also and mainly in bottom line.